If you invest some time looking for private student loan forgiveness programs, you’ll very quickly recognize there aren’t any specific programs availa-ble. In reality, the closest thing to a forgiveness scheme is a reduced sum agreement.

Numerous students who are suffering from the huge amount of unpaid debt can use the services of a competent negotiator to agree arrangements with a loan provider therefore helping a debtor steer clear of the stress and concern about struggling to repay a high balance loan.

Private loans are exempt from going bankrupt and if you’ve taken out a private loan, you’ll also realize there is plenty of protection given to the loan provider and very little to the borrower. On top of this, a debtor has remarkably few alternatives when it concerns available payment plans.

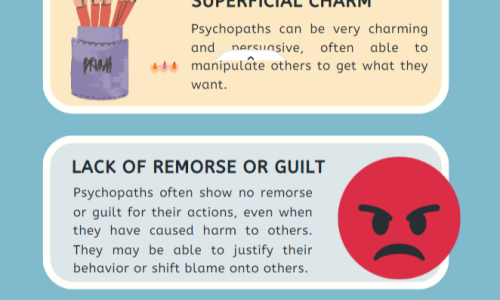

Navient is well known for being a very aggressive loan provider. They will rely on applying as much pressure as feasible to get students to pay up. They accomplish this by utilizing collection law companies and threatening letters.

If you’re searching for Navient student loan forgiveness, the best thing you can do is get in touch with a competent arbitrator who can really help you find your way through all the complexi-ties.

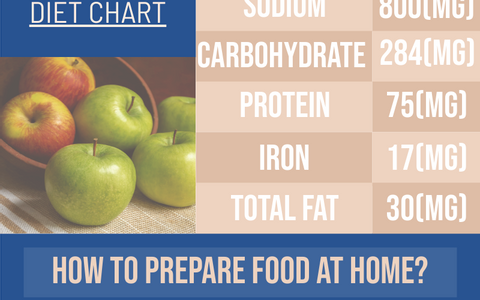

Infographic source: Mycredit Counselor

57 total views , 1 views today