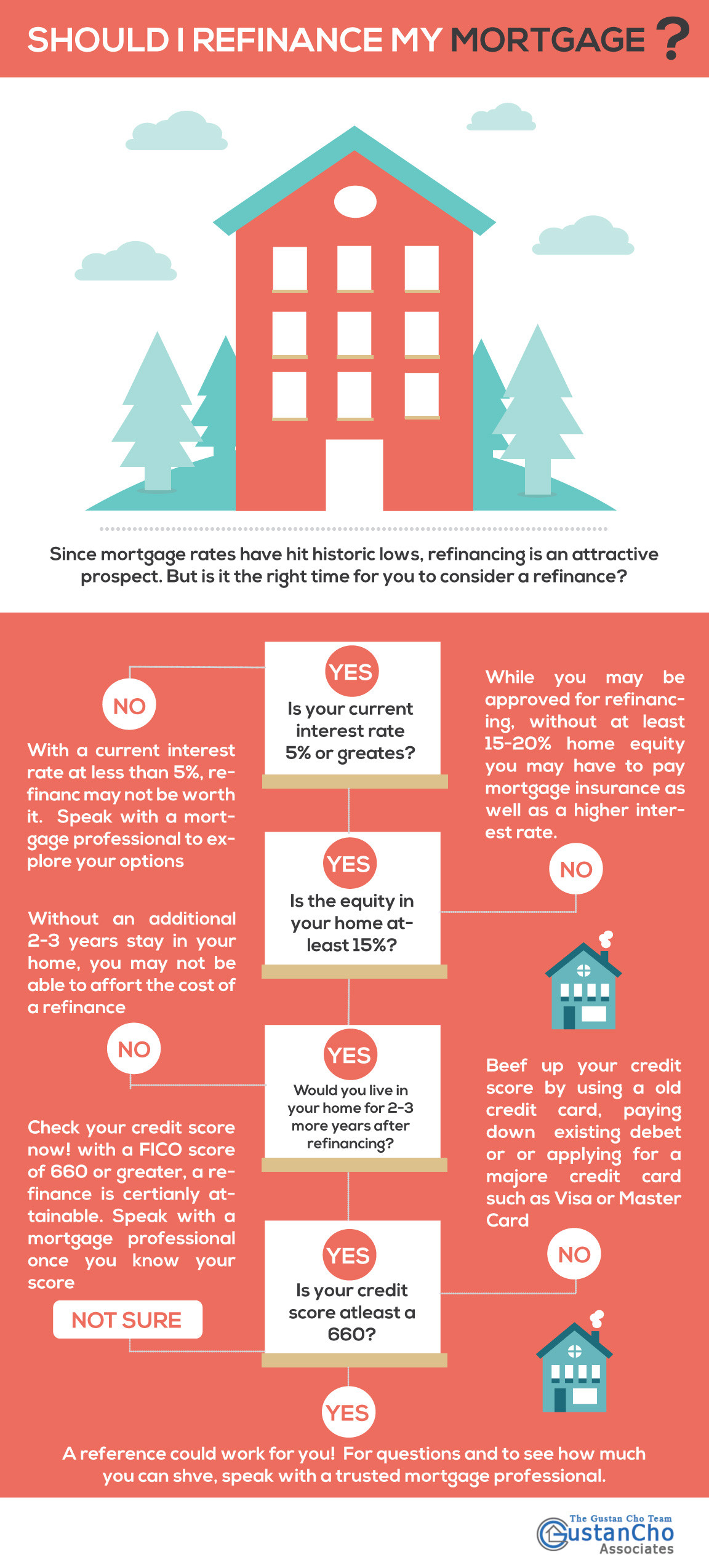

Over the last couple of years with interest rates at a 40-year low, many people refinanced their mortgages. Even though rates have crept up over the last couple of months, refinancing may make sense for you. Use our refinance calculator to analyze your situation today!

There are many refinance mortgage loan programs such as HARP refinance mortgage loans, Reverse Mortgages, FHA streamline refinance loans, FHA 203k streamline refinance loans, VA streamline refinance loans, FHA cash-out refinance loans, USDA refinance loans, USDA streamline mortgage refinance loans, Conventional refinance mortgage loans, Jumbo refinance loans, Jumbo cash-out refinance loans, condotel unit refinance loans, and non-warrantable refinance loans.

Many homeowners have purchased their home right after the 2008 real estate and financial meltdown at the low of the real estate market. Home buyers who have purchased their homes from 2009 and forward have gotten their homes at rock bottom prices and many home buyers who purchased during that time have seen their home values appreciate 20% or more.

Home homeowners, especially in Illinois, Florida, and California enjoyed appreciation as much as 50%. Homeowners with equity can explore doing a FHA cash out refinance mortgage. A homeowner can do a cash out FHA refinance mortgage loan up to a 85% loan to value.

Homeowners with a current FHA insured mortgage loan can do a FHA Streamline Refinance Mortgage with no appraisal required, no income verification, and no credit score required. The FHA Streamline Refinance is so simple and fast tracked that most FHA Streamline Refinance Mortgage Loans can close in as quick as three weeks depending on how fast the mortgage loan borrowers submits his or her conditions in to the mortgage loan processor and into the hands of the underwriter for review.

If you are a homeowner with a home in need of repairs, you can explore the option of refinancing your current mortgage loan, whether it is a conventional loan, FHA loan, VA loan, USDA loan, to a FHA 203k refinance mortgage loan where the mortgage lender pays off your current home loan and gives you a new loan with rehab budget.

Infographic by Benefits of Refinancing Mortgage

294 total views , 1 views today